Why Use Derivatives & Balance Sheet Hedging?

There are multiple assets competing for a spot on an institution’s balance sheet, and ALM First Financial Advisors believes interest-rate risk shouldn’t be grounds for exclusion. Instead, meet the demands of your market, and then manage the interest-rate risk through our proven hedging solution. Derivative hedging techniques can help your institution retain core, longer-duration assets by managing the interest-rate risk that accompanies them. With a robust risk management process, your institution can improve its safety and soundness and help broaden the spectrum of products and services offered.

Choosing ALM First Financial Advisors

ALM First Financial Advisors provides:

- Proven Expertise: Our team of experts has deep experience utilizing derivative hedging for both banks and credit unions. In addition, we work with financial institutions on successful hedging strategies, and we participated in the NCUA Derivatives Pilot Program. ALM First Financial Advisors also played an instrumental role in the final 2014 regulation.

- Turn-key Hedging Solution: Our expert guidance, analysis, and industry experience enables us to effectively utilize hedge instruments and reduce interest rate risk for our clients. We offer a turn-key hedging solution including consulting and advisory services.

ALM First Financial Advisors’ Derivatives & Hedging Expertise

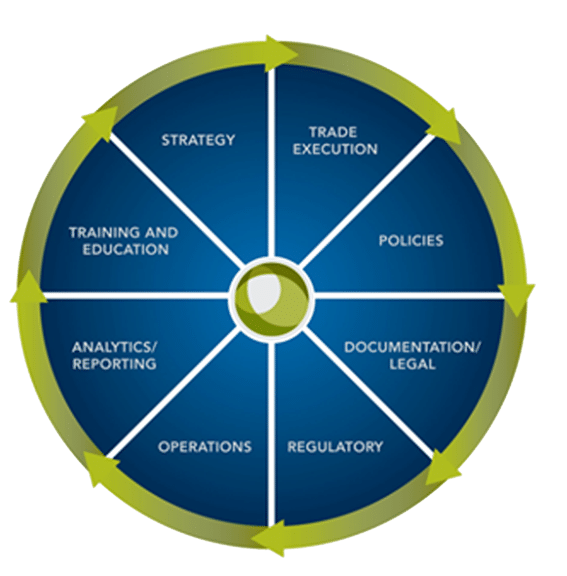

ALM First Financial Advisors’ team of experts will work with you to:

- Develop strategies to optimize your risk profile through hedging with derivatives

- Provide education and training

- Navigate the regulatory approval process

- Establish relationships with counterparties

- Execute transactions without bias

- Monitor, analyze, and report hedge positions on an ongoing basis

- Implement hedge accounting

- Protect against unlikely events and outlier interest rate scenarios

- Increase net interest margin stability

The ALM First Approach

Capture historical data on marginal liability rates, and then compare these data against a market interest rate using a linear regression. A correlation coefficient of 0.80 or greater is desired. This step will ultimately help determine the interest rate swap’s floating rate.

Create a “hypothetical” perfect hedge that will produce a comparative benchmark. The hypothetical hedge should have characteristics including longer duration, different rate structures, call features, or resets and repricing dates.

Execute the actual swap that contains as many of the parameters of the hypothetical perfect hedge as possible. Doing so should help maintain hedge accounting treatment under FAS 133.

Reevaluate the interest rate swap at least quarterly. Review the correlation, confirm that the notional value of the liability is greater than or equal to the notional value of the swap, and compare the mark-to-market value of the actual interest rate swap and the present value of the hypothetical perfect hedge.

Additional Advantages with ALM First Financial Advisors

Avoiding sectors or specific assets is usually a sub-optimal approach to risk management when compared with hedging. By managing your risk more effectively through hedging with derivatives, your institution can benefit from:

- Enhanced income (rates are lower relative to term borrowings)

- More capital efficiency

- Sophisticated, detailed analytics including performance feedback loops and comprehensive monthly reports

- Trusted operations, monitored collateral, confirmed trades, and counterparty credit analyses

- Decreased interest-rate risk and credit risk (gains are collateralized)

- Greater liquidity

When is it desirable to mitigate risk? When is it not?

An institution should mitigate risk when the cost to eliminate risk is cheap and when managing risk is a better option than avoiding risk. An institution should be careful without the necessary education or support, as improper risk mitigation can be expensive and therefore not cost-effective.

How do you recognize the cost of hedging?

It is important to consider and minimize hedging costs. Hedging costs can be in the form of:

- Roll yield (cost of carry of the hedge instrument)

- Transactions costs

- Offset ineffectiveness (i.e., unequal market value movements)

Why hedge instead of borrow?

There are clear advantages to hedging:

- Hedging does not decrease the capital-to-asset ratio for transactions that are off balance sheet.

- Borrowings are not liquid, and if your institution needs to liquidate a position, it can be very costly. Interest rate swaps and caps are extremely liquid and can be sold for a gain or loss.

- Borrowing brings hedging benefits to the balance sheet, but it also comes with the risks of investing or deploying the funds. Derivatives simply do not have these leverage and investment issues to contemplate.

- Credit risk is mitigated via bilateral agreements requiring daily margin maintenance or via tri-party custody or via clearing.

What are factors that could contribute to imperfect tracking?

Tracking is partially based on model assumptions, and these can influence the results. Some examples include:

- Duration estimates

- Convexity estimates

- Rebalancing (rate volatility)

- Imperfect correlation

What are the components of an interest rate cap?

An interest-rate cap is a derivative which protects the buyer from rising interest rates.

- Cap Term = Length of time between initial agreement and termination of contract

- Cap Index = Rate type on which the contract will be based (most likely LIBOR)

- Cap Strike = Maximum rate to which the underlying index can increase

- Cap Premium = Cost to purchase cap; can be amortized over the life

A Cap’s payout is based upon the strike of the Cap relative to an underlying index. If the underlying index exceeds the Cap strike, the buyer of a Cap receives a payment equal to the index minus the Cap strike rate times the notional amount of the Cap.

Get Started Now

Contact us today to discuss our turn-key consulting and advisory service and the advantages derivatives can provide you.

All investing is subject to risk, including the possible loss of the money you invest.

“ALM First” is a brand name for a financial services business conducted by ALM First Group, LLC (“ALM First”) through its wholly owned subsidiaries: ALM First Financial Advisors, LLC (“ALM First Financial Advisors”); ALM First Advisors, LLC (“ALM First Advisors”); and ALM First Analytics, LLC (“ALM First Analytics”). Investment advisory services are offered through ALM First Financial Advisors, an SEC registered investment adviser with a fiduciary duty that requires it to act in the best interests of clients and to place the interests of clients before its own; however, registration as an investment advisor does not imply any level of skill or training. Moreover, ALM First Financial Advisors, LLC (“ALM First Financial Advisors”), an affiliate of ALM First Group, LLC (“ALM First”), is a separate entity and all investment decisions are made independently by the asset managers at ALM First Financial Advisors. Access to ALM First Financial Advisors is only available to clients pursuant to an Investment Advisory Agreement and acceptance of ALM First Financial Advisors’ Brochure. You are encouraged to read these documents carefully. Balance sheet advisory services are offered through ALM First Advisors. Financial reporting services, loan introduction services, and other special project services are offered through ALM First Analytics. Neither ALM First nor any of its subsidiaries provide legal, tax, or accounting advice. This firm is not a CPA Firm.

INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, ALM FIRST OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED.